how does inheritance tax work in florida

You pay full taxes on any value between 25000 and 50000. The lowest tax rate applying to excess amounts of 1 10000 is 18 while the maximum tax rate applying to excess amounts of 1 million or more is 40.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

If someone dies and has a surviving spouse and no children that arent also the spouses children the entire estate passes to the spouse.

. The inheritance itself is not income to you. For example if they sell your home theyll pay taxes on any profits between the sales price and the stepped-up basis which is the value of the property at the time of death. The current rate is 40 and this is only charged on estates that exceed a certain.

Inheriting from a non-US. The value of the bequest the deceaseds relationship with the recipient and the jurisdiction where the decedent resided or possessed property are all factors that determine. What Is an Inheritance Tax and How Does It Work.

If you schedule a free consultation with us Weidner Law our attorneys will describe the trust several. If you held the property for one year after death the gain in the property may be a capital gain. Beneficiaries will pay taxes on any inheritance they sell.

There is no inheritance tax in Florida but other states inheritance taxes may apply to you. If youve inherited property from someone you wont have to pay the federal estate tax however. There are no inheritance taxes or estate taxes under Florida law.

If you have an irrevocable trust you can protect your estate reduce several types of taxes and examine multiple exemptions. Florida does not have a separate inheritance death tax. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate.

The general rule is that the inherited property is treated on a step up basis meaning you do not have to pay taxes on the difference between the price paid for the asset of the deceased and what you sold it for. Most beneficiaries will pay a capital gains tax rate of 20 but it may vary. Florida also has no gift tax.

However federal IRS laws require an estate tax. In cases where the decedent does not leave a Will or have a living trust assets are distributed per the laws of intestate succession. As noted above Florida does not impose either of these taxes.

Tax returns within three and a half months from the end of your fiscal year two and. If an inheritance is greater than 117 million only the amount over 117 million will be subject to the federal estate tax. To get answers to specific questions about your Florida probate case click here or call 352 354-2654.

Its against the Florida constitution to assess taxes on. In Florida property tax valuation many ingredients go into the mix. If you have assets in other states which do this may complicate your estate planning matters.

The federal inheritance tax is graduated meaning that the larger the amount of money in excess of 117 million the higher the rate at which it is taxed. However heres a rough idea of how the tax is applied. The first 117 million will be exempt.

Youll need to check the laws of the state where the person you are inheriting from lived. Estate taxes are paid by the estate before the assets are distributed to beneficiaries while an inheritance tax falls to the person inheriting the asset. In other words the estate must pay the estate tax before it can.

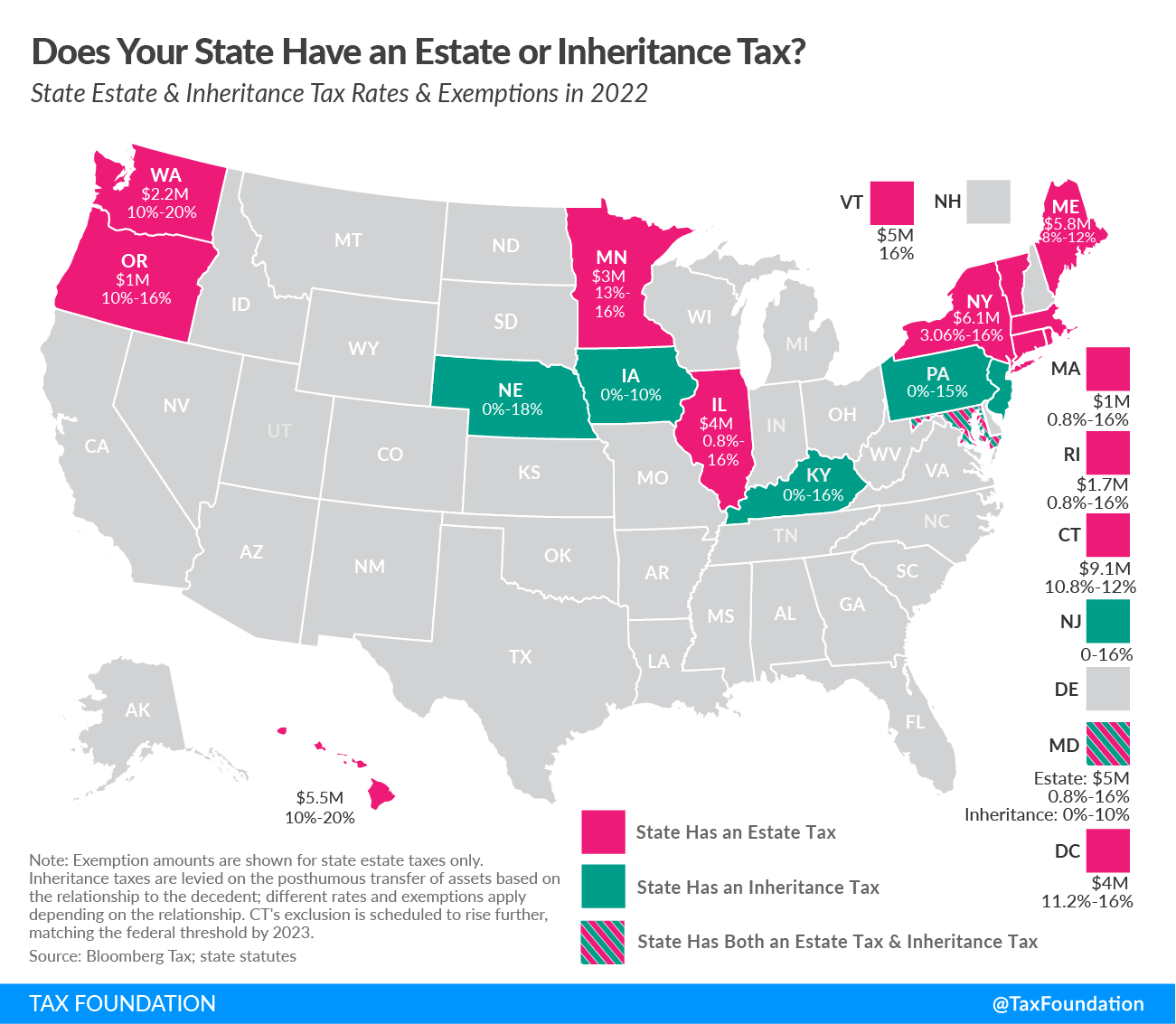

Fifteen states levy an estate tax. Inheritance Tax in Florida. In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state.

1 which assets are required to go through probate 2 who is entitled to receive those assets and 3 what steps are required to transfer those assets. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. Inheritance tax is not dealt with directly by your beneficiaries but by the executor of your will.

An irrevocable trust will also protect many assets from creditors and the trust can help you to avoid estate tax. For any assessed value between 50000 and 75000 an additional 25000 is eligible for exemption. Florida does not collect an estate tax.

The State of Florida does not have an inheritance tax or an estate tax. The deceaseds estate must pay the estate tax before any property is distributed to the beneficiaries. If someone has children from outside the marriage half of the.

This exemption does not apply to school district taxes. It must show each asset in each location. There are exemptions before the 40 rate kicks in and an attorney can provide advice on setting up your estate to minimize taxes.

Yet some estates may have to pay a federal estate tax. Florida doesnt collect inheritance tax. In Florida your surviving spouse inherits your entire estate if there are no surviving children or if any children also are your surviving spouses children.

The above exemption applies to all property taxes including those related to your school district. Florida law requires taxable entities with assets higher than 25000 that control business or investment property to file a tangible personal property return by April 1 st yearly. If you are survived by children who are not those of your surviving spouse your spouse inherits half of the estate and the children inherit equal shares of the remaining half.

Appealing Your Property Tax Valuation. This guide explains the entire probate process in Florida including. The good thing is that income tax would only be based upon the increase in the propertys value from the date of the decedents death if any.

For instance if you receive an inheritance of 15 million the federal income tax rate will only apply to 33 million of your inheritance. An estate tax is a tax imposed on the gross estate assets and the tax is paid at the estate level before going to the beneficiaries. Everyones financial situation is unique and the impact of inheritance tax will vary person to person.

Inheritance taxes are taxes levied by certain jurisdictions on people who have inherited or bequeathed property from a deceased persons estate. An example would be if your dad bought a stock for 5 in 1990 but was worth 12 when he died in 2010 and you sold it in 2011 for 15.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Does Florida Have An Inheritance Tax Alper Law

Does Florida Have An Inheritance Tax Alper Law

Florida Estate Tax Rules On Estate Inheritance Taxes

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Inheritance Tax Here S Who Pays And In Which States Bankrate

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Center For State Tax Policy Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How To Calculate Inheritance Tax 12 Steps With Pictures

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Foreign Inheritance Taxes What Do You Need To Declare

Is Your Inheritance Considered Taxable Income H R Block

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

401 K Inheritance Tax Rules Estate Planning